Automating finances and why I love it!

Let’s be honest, running the financial side of your family affairs takes time, it takes effort, and takes discipline. Mundane tasks such as bill payments and shuffling money between accounts require your attention. Even small things take time that is a precious commodity these days especially if you have kids. Somehow you need to remember due dates, amounts, different bill types, save for retirement, invest your money, send checks, and prepare for large expenses coming up … This almost sounds like a full time job sometimes.

Would it not be wonderful if all of these things were happening automatically? This is what I call automating finances - making sure all these tasks happen independently of your actions. You can be busy doing something else or even be traveling in South America yet your financial affairs would require very little of your attention, and can run themselves automatically.

Automating Finances

Here are three biggest reasons why I would consider automating my financial affairs:

- I’m a fairly lazy guy.

Not that I don’t like doing all of it, but I’d rather do something else. World is full of interesting things to do. We all have hobbies, we have sports, trips to the gym, newest season of Walking Dead on Netflix, fun and educational podcasts to listen, good book to read, socializing with your spouse, spending time with your kids, playing with your pets … I can go forever, but you get my point.

Also, I’m not very disciplined.

I’m not the best person to be trusted with mundane boring tasks that need to be completed on a regular basis. I have attention span of a toddler and severe “Oh! Look, a squirrel!” syndrome. Something about paying bills just doesn’t excite me! Perhaps there are people out there who go “Yippee!” every time they need to pay their utilities bill, but I’m not one of them.

Lastly, it takes time.

Time that none of us have. I work full time, so does my wife. My wife also goes to school and has assignments and tests to pass. Throw in household chores, cooking, occasional trip here and there - and the amount of time left for personal finance is minuscule.

So, few years ago I went on an automating finances crusade. I’ve decided to put as many personal finance tasks on autopilot as possible to limit my involvement with them and also to make sure I’m never late with any of the bills, never pay late fees, and free up my time for other more important things in life (did I mention the new season of Walking Dead on Netflix?).

Here’s what we did!

Automating Income:

Just few years ago, my paychecks were given to me in a form of actual cheques. Then I’d have to go and deposit them in my bank, wait some time while the checks were being processed, and only then I’d have access to my money. On top of it, it’s very easy to lose an actual cheque if you carry it around in your wallet.

So, one day I’ve marched into our accounting office and inquired if my paycheck can be deposited directly into my account. Few days later my paycheck was going straight into my account - no more holding periods, no more carrying it around in my wallet, no more trips to the bank. I can be away on a camping trip, and my paycheck will still go into my account without my involvement. Easy as pie!

Automating Expenses:

To automate our financial life to the fullest, we couldn’t just focus on automating our income. We also had to automate expenses. This means utility bills, gym memberships, Netflix dues, strata fees, and many others. How can one pay all of them without actually doing any work?

Electronic bill payment is the answer. All of our utilities are paid automatically out of our checking account. Gym memberships along with Netflix are billed automatically to our credit card. Strata fees and mortgage payments (and rent payments before we bought our home) are automatically ETFed from our account.

You’ll be surprised how much vendors love automatic payments. To them it means they’ll never have to call you for yet another missed payment and cuts down on their paperwork. To us it means all bills are taken care of even if I’m napping for 8 hours straight or doing a late shift at work. No need to remember due dates for bills, no need for writing cheques and licking stamps.

PS: Keep in mind, we keep our financial affairs extremely simple by minimizing the number of accounts we have.

Automating Budgeting:

When one says “budgeting”, people usually cringe because right away they imagine an extremely boring process of planning your every meal, balancing accounts, and counting pennies. But budgeting can be extremely hands-off process with minimal amount of time spent.

We use Mint.com to keep track of every single transaction going through our accounts. All we had to do is to sign up for absolutely free membership, add our accounts information, and go through a simple process of categorizing our transactions into spending categories - household expenses, groceries, car and repairs, etc.

Mint.com automatically tallies your budget for the month and gives you an overview of your finances. Whether you are in the positive or negative, you’ll be able to see it right away. After that you just have to make minor changes to your spending habits. Mint.com does the rest by automatically updating all of your transactions.

The budget for next month is created automatically using your previous month budget. No need to sit and balance your check book with a calculator in hand!

PS: We never use cash in our household because we hate it. Not using cash and only using plastic makes budgeting using Mint.com extremely easy and straightforward.

Automating Credit Card Payments:

Missing a credit card payment can have dire consequences on your finances. First of all, you’ll have to pay interest fees on the amount you’ve borrowed. With average interest rate in Canada being 18%, we’re talking about a lot of money being lost due to simple forgetfulness. Also, your credit score can get hit which will make borrowing harder or more expensive.

Thankfully, there are ways to make your credit card payments automatic. Some banks give you an option of paying your credit card balance in full on due date. Some banks offer to pay at least a minimum payment without your involvement.

My credit card company unfortunately doesn’t do any of it but there’s an option for automatic statement delivery by email with a quick reminder before the due date. So, while it’s not exactly automatic, it still prevents us from forgetting our credit card bill. Once the email comes in, I just have to quickly log into my bank account, and process the payment which I can do from the comfort of my home, my car, or even while away in another country.

Check with your bank how you can automate your credit card payments - it will save you time and money.

Automating Annual Purchases:

We have a number of expenses that happen annually. For example our rather hefty property tax bill and car insurance. Before we figured out how to tackle them, they would always throw a wrench into our finances and send us into panic mode. All of a sudden we’d have to find money in our budget for them which meant cutting something else out and not eating for at least two weeks just so we can pay them (mostly kidding!).

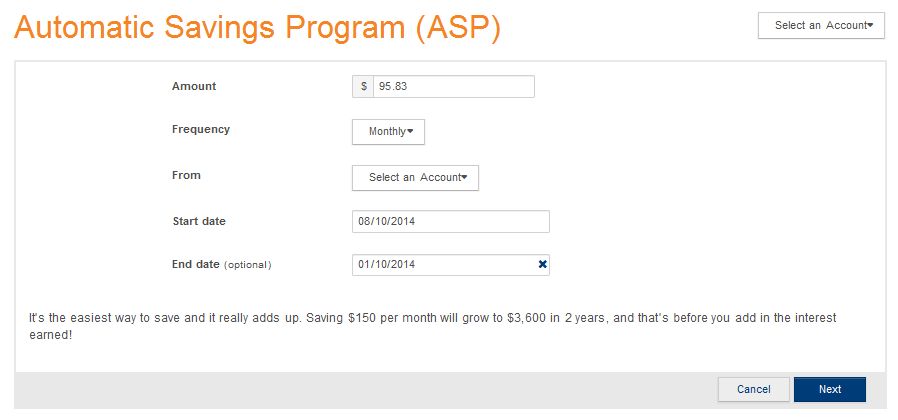

But now we have a great system in place. With our Tangerine bank account (which I never get tired of promoting because they’re awesome!), we’ve opened two additional savings accounts just for property taxes and car insurance. Then we’ve set up monthly transfers of money into these accounts. Twelve months later, we have enough money in them to pay off our taxes and car insurance without any pain or worries.

It only takes 5 minutes to set up additional savings accounts with Tangerine and automatic transfers into them. Once it’s done, you can forget about them entirely as the monthly transfers will happen automatically. Twelve months later you’ll have enough money in these accounts to pay them. You won’t have to remind yourself to save money towards them as it’s done automatically, and you won’t have to do anything besides repeating the process once a year.

PS: Some banks, such as Tangerine, will actually help you to figure out how much you have to save on a monthly basis to reach your goals and automatically set you up with monthly transfers. Just another reason why I love Tangerine.

Automating Finances

Automating Paying Yourself First:

Paying yourself first is one of those things we all know we’re supposed to be doing, yet many people fail to do so. Why? Because we fail to do it automatically.

We all promise ourselves to save money from every paycheck but life happens. Sometimes we simply forget about it. And sometimes we have other priorities at hand. What can you do to automate this process?

Just like annual expenses mentioned earlier, we pay ourselves first automatically by setting up monthly transfers from our checking account to our savings account. All we had to do is to decide what portion of our paychecks will be going towards retirement (currently we have the goal of 30%) and set up an automatic transfer of these funds. Once a month, our checking account gets zapped without us doing anything and “paying ourselves first” payment gets transferred into our savings account.

Automating Investments:

If you invest your money in mutual funds, there are some great ways to automate finances for your household.

Just like banks and utilities companies, mutual fund brokers love automatic plans. For example, if you’ve decided to invest $600 every month, your mutual fund broker can set up a monthly investment plan for you and have $600 to be transferred out of your account into investments every month without you ever touching your checkbook. You’ll never have to remember to invest your money as it will be done automatically on your behalf into selected funds.

Some of the mutual funds can even re-balance automatically on annual basis without you being involved at all. Target-date funds re-balance themselves automatically as you age according to approximate retirement date you’ve chosen.

Automating Extra Mortgage Payments:

Those of us with mortgage payments always promise ourselves to pay extra on it to get rid of it sooner. We always want to save some money and throw it as a lump-sum payment. But life always gets in the way, we forget about putting money aside for it, and at the end of the year have nothing left for the lump-sum payment.

Solution for us was to simply ask our mortgage company to automatically charge us a little bit more with every payment. All you have to do is to pick up your phone, and politely ask the customer service person to increase your payment just by 5% every month. You will start paying extra on your mortgage automatically without any extra work of putting money aside. Any time you receive a raise or your income increases, simply ask the mortgage company to raise the payments again.

The result of automatic extra payments on your mortgage will be paying off your property years ahead of schedule and saving a bundle in interest charges. And the best part it’s automatic and only takes few minutes to set up. What are you waiting for?

The result

Automating finances took a bit of time to set up. But the end result was worth it as now our financial affairs are on autopilot for the most part. I don’t have to pay attention to them, exercise discipline, and keep track of things. Things happen in the background without our involvement!

We also cut down considerably on stress. Late fees are now things of the past. We have more time to spend doing something more enjoyable than paying bills! I think almost everybody can benefit from automating finances to some degree, so I hope I gave you few ideas.

***

Look, you can even automate playing with your dog!

Automating Finances