Why do you need more than one savings account?

We have a number of saving accounts. While some people are quite happy with having just one saving account, I like having a number of them for all our needs. To me, it just makes your saving goals clear and defined. You need to save some money for a new TV? Well, figure out how much money you need and make sure by certain date there’s that much money sitting in your “New TV fund” account - as opposed to lumping your savings into one account and not knowing what goals still need to be reached.

- Investment account or what I call “Paying Ourselves First” account. This is where we transfer a set percentage of our income to be later invested.

- Emergency fund. This is our rainy day fund - anytime we have an emergency, we have access to our own safety net as opposed to borrowing money or using credit cards. I already covered the importance of having an emergency fund a while ago. Last time our dryer broke down, the money came from our emergency fund without breaking the bank or monthly budget.

- Gifts. My wife is one of the kindest and giving women I’ve ever met. She loooooves giving presents - and she gives a lot of thought to presents. Her brain has a built in calendar for birthday dates of anybody we’ve ever met. I on the other hand have terrible memory and can never pick anything meaningful - partly because I’m a practical kind of a guy. To make sure gifts and presents never throw our budgets out of whack (how it used happen right before Christmas), we’ve came up with a monthly figure we contribute towards gifts. It accumulates there month after month, and my wife can spend it anytime she needs.

- New Car account. Our car is closing on 20 years by now - but it is in excellent shape and fairly low mileage of just over 200K. There’s not a single thing wrong with it, and for its age it looks absolutely fabulous. Honestly, it will be hard for me to say goodbye to our Donkey (that’s what we call it between me and my wife). But you never know what happens, and there might be a day when the engine completely gives or it gets stolen. Just in this case, we’ve been saving money for a new car - if the need for a new car arises. By now it’s almost fully funded, so we can just write a check and buy a new car - but for now we’re perfectly happy with our Donkey.

- Annual property taxes. We own our condo, and one of the pleasures home ownership comes with is the annual tax bill. Thankfully, our condo if quite affordable when it comes to taxes, and we just have to save around $90/month. Once a month we transfer $90 into this account, and come July pay our taxes. Easy, peasy, nice and breezy.

- Annual car insurance and condo insurance. These are pretty self-explanatory.

On top of it, sometimes I open accounts for small things we’re saving towards, for example a new couch or anything else we might want to buy that we have to save towards over few months.

What is the best bank for saving money?

Here’s how I define “the best bank for saving”:

- It has to be absolutely free. I haven’t paid any service fees in years, and would never pay for banking. No, even free banking in exchange for a min. balance won’t cut it - it has to be absolutely free!

- Funds have to be guaranteed by Canada Deposit Insurance Corporation (CDIC). If your bank goes bankrupt, CDIC will cover your funds up to $100,000.

- It has to be flexible. If we need to open an account, it has to be done quickly. Transferring money should be quick and painless.

- Money should be accessible at any time. Online, over the phone, or through an ATM.

Why I’ve chosen ING DIRECT?

I’ve been an ING DIRECT client for over 10 years by now, and I still consider them the best bank for saving money. I still remember their cheesy TV commercials when they first came to Canada - energetic fella telling us to “Save your money!” with a Dutch accent. It sounded so fresh and different from other banks, I had to check it out! Well, a mind-boggling interest amount paid out they’ve been proudly displaying online didn’t hurt.

1. ING Direct is absolutely free. No fees, no minimum balances.

2. ING Direct has an absolutely awesome mobile app to access your account along with online banking, phone banking, and access to ATMs. I’ve never had problems with getting a hold of customer service people, and their mobile web site is top notch. As a younger person, it is especially appealing to me - as transferring money on my iPhone sounds way easier than a trip to the bank branch.

3. ING Direct actually pays interest. While it’s not super high (1.35% last time I checked), it’s still higher than any “brick and mortar” bank such as RBC or CIBC.

4. You can deposit checks into your account (if you happen to have a checking account with ING) in your bedroom! By taking two pictures of a check with their app, you can deposit money straight into your account without the time-consuming trip to an ATM.

5. You can create as many accounts as you want. They all appear instantaneously online once you create them. Just as easy you can close them, move money between then, and set up savings goals. Every time me and my wife decide we have to start saving for something, we instantly open up an account and set up a monthly transfer goal.

On top of it, they also offer other products such as no-fee checking account (Thrive account), GIC’s, mutual funds, business accounts, and mortgage loans. On a side note, they happen to be the only bank in Canada that posts their real mortgage rates, as opposed to playing “bait and switch” game that other banks are famous for. I’m not familiar with their other products, so I’m not going to say much about them.

If you want to open a new account with ING…

It is surprisingly easy to open a new account - just go to their website, and have your SIN number ready. You’ll be surprised at how you lived without them after a while! And I know they’ve been bought out by HSBC recently, but personally I have no issues or worries about it. It’s a great business, and people who run it take a great pride in helping people save their money and reach their financial goals.

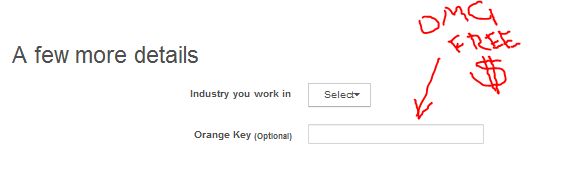

FREE MONEY???

1. Go to Tangerine Bank

2. Locate “Tangerine Savings Account” in the list and click “Enroll Now”

3. When filling out all the personal information, enter my Orange Key 14213984S1

Both you and I will enjoy some free money. No work involved besides signing up for an account. Life is beautiful, eh?

I am Financial Underdog, and I highly recommend having multiple bank accounts for your savings!

Pingback: Goals and Resolutions for the year of 2014Money Ramblings()