Just few years ago

… our finances were a mess. When I and Mrs. Financial Underdog combined our lives, we didn’t quite combine our finances. Each of us came into marriage with some debt, some credit cards, some savings, and even some investments. Unfortunately, when combined all of these accounts created a mess! It was extremely hard to keep track of our money, and it started to cause some serious problems. But through some hard work and few simple moves, we’ve managed to achieve financial peace and bring financial Zen to our money situation!

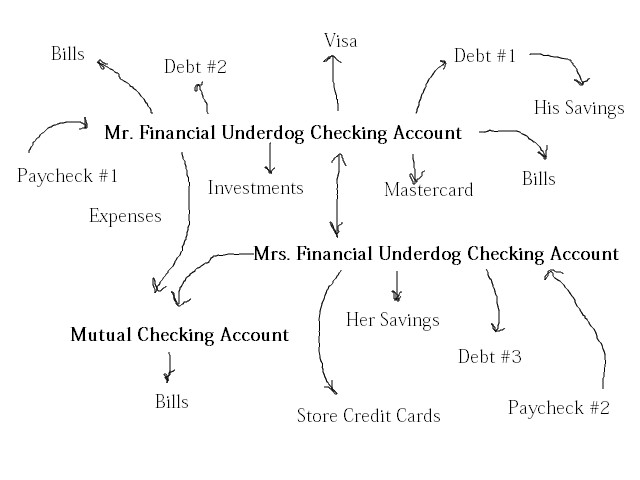

To give you a basic idea of what our financial situation looked like, please see attached sketch. And while it looks like the works of a marginally talented 3-year old, let me assure you - it was all me.

Achieving Financial Zen

Both of us had checking accounts where our paychecks went. Both of us paid some bills - cell phones, and other personal expenses. We’ve even started a mutual checking account where would deposit money for rent and utilities. We’d also share some expenses and would transfer money between out accounts on a regular basis to make things “fair”. Both of us had credit cards we’ve used, and paid separately. If there was any money left over after bills and debt repayment, we’d transfer it into separate savings accounts - but more often than not there was nothing left over. Some bills would be “mine”, some would be “hers”, and some would be “ours”. On top of it, I had student loans which needed to be paid separately.

As you see, it was a complete mess and confusion. There was nothing Zen about this situation.

Problems and issues

- Complete lack of clarity. While on surface we were getting by just fine, this financial picture was a complete mess. At any point of time, we wouldn’t be sure how much money exactly we had currently. Between multiple accounts and multiple credit cards, we would never know for certain what the balance on them is because it would require checking online statements several times and comparing them.

- Honey, can we afford to buy {something}?

- I have no idea; give me two days to figure it out!

- Late fees and penalties. Because we weren’t clear on our finances, it was very easy to lose track of all the payments and bills. Let’s face it, if you’re not sure what your balances are and when they’re due because you have so many - some of them will be paid late. This would cost us considerable amount of money in late fees and interest charges. Money down the toilet!

In addition, multiple checking accounts meant that we were paying multiple monthly fees. Unacceptable!

- Stress and uneasiness. Because of how messy our finances were, I personally felt the never-ending stress about money. It felt like we were always putting out financial fires. Oh no, another visa bill is overdue! Let’s transfer some money there! Oh wait, rent is coming up - let’s transfer money here!

Even if we had enough money coming in, it always felt like every day is an emergency. How can you be in peace with your finances in this situation? It’s impossible. We needed some financial Zen!

- Lack of focus on debt repayment and savings. As a consequence of it all, we really didn’t make any progress on debt repayment or savings. Because we always felt like we don’t have enough money, debt repayment wasn’t a priority. We never even thought about increasing our payments, and we mostly focused on just paying minimum amounts. Same thing with savings - saving money in our case was merely an afterthought. If it was one of those rare months when we had money left over, we’d plunk it into savings accounts with no rhyme or reason - simply because we felt it was the right thing to do.

- No savings goals. What little savings we’ve had wasn’t earmarked for anything. These funds were simply sitting in two savings accounts for no reason. Any time we wanted to buy something, we’d take the money out of these accounts as a blind pool.

How we’ve changed our finances:

One day we’ve decided we’ve had enough of this mess. I happen to be the kind of person who cleans and scrubs when stressed out. Sounds weird, but putting things in order and washing the car calms me down and gives me a feeling like I’m in control. With our financial mess, multiple checking accounts, multiple credit cards, never ending transfers between accounts, and late notices, we were far from being in control of our personal finances. So, what was the solution? Cleaning and scrubbing our finances - to the max!

Complete personal finance cleanup!

Giant overhaul of our finances!!

Scorched earth tactic applied to money!!!

Napalm bombing of all our accounts and starting from the very beginning!!!!

Taking every account we have into a giant pile, lighting it on fire, and starting from the clean slate!!!!!

Financial Zen

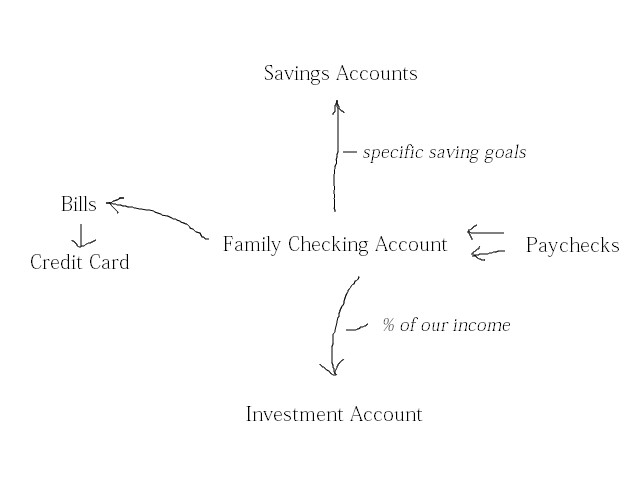

- We now have only ONE checking account. Both of our paychecks get deposited into it, and we pay all of our bills from this account. We no longer have “my account”, “her account”, and “our account”. Everything is combined and no accounts on a side. What’s mine is hers, and what’s hers is mine. All other checking accounts have been canceled.

- We now have only ONE credit card. Ideally, I wouldn’t have it at all. But we do occasionally buy things on Internet, so it’s nice to have it as a payment option, not source of funds. Since it’s the only one we have, we never miss a payment on it, and always know the balance. Other credit cards have been paid off and canceled! Take that, big banks!

- We’ve combined all of our debts (and paid them off). When we’ve combined all of our accounts, we’ve found that we can actually afford to increase payments on the debts to get rid of them much faster. Over a year or so, we’ve combined the debts and paid them off. Even without paying them off, combining them was a fantastic move as it gave us a clear picture of how much exactly we owe and how much we can put towards it.

- We have multiple savings accounts with specific goals. Instead of having a faceless pile of savings with no specific goal, we now have multiple savings accounts with specific goals attached to them. For example, we have our gift account where we deposit a specific amount of money towards gifts. We have an account for a new car (in case our current car dies on us because it’s gazillion years old) - and we know how much we would like to have saved up for it. We have other accounts for annual expenses with specific goals we’re working towards.

- Investing became a new-found focus for our family. Because we no longer carry any debt (outside of mortgage), we can actually put away money towards investments for our future. We know exactly how much we can afford, and investing no longer seems out of the question for us. Before our financial picture looked blurry and confusing. Now when it’s clear and simple, we can invest money with confidence without worrying about needing money later for yet another credit card bill or unforeseen expense.

- NO MORE STRESS! Now our financial picture is crystal clear. Keeping an eye on accounts is an easy task comparing to how things used to be. We feel confident about our finances. We never miss any payments (well, except for that ONE time!).

This is what I call Financial Zen - complete confidence about your finances, your goals, and your progress. It has nothing to do with how much money we’re making (or how little!), but with financial peace that you feel when you’re completely clear about the state of your financial being. Getting rid of all extra accounts, multiple credit cards sure helped us achieve it. Not only that, but we keep our financial affairs as simple as possible on purpose - because simplicity means calm and complete lack of stress!

- We feel united. Our finances are in complete unity. We no longer have “his”, “ours”, and “her” accounts. We just have one OUR account, nothing else. We plan and act in unity when it comes to money. If anything, this little exercise combined us as a family, and taught us how we should communicate about money.

Action steps if you’d like to achieve Financial Zen:

I highly recommend you do the same if you ever feel stressed about money. Regardless of how much money you’re making, you can reduce stress and run your finances more efficiently if you simplify your affairs. Doesn’t have to be as drastic as in our case, but you’ll feel much better every time you cancel yet another unnecessary account or credit card.

1. Make a complete inventory of your financial life. Make sure to include all accounts that you and your spouse have - checking accounts, savings accounts, credit cards, outstanding debts and loans, investment accounts, and stacks of fast food coupons (kidding!)

2. Open one checking account for your family which becomes your only checking account from now on. Deposits all paychecks into it, and pay all bills through it. Empty out and close all other accounts - including “his” and “hers”. While there are many options, Tangerine offers fully-featured checking accounts with no fees of any kind and always been my favorite!

3. If you need a credit card in your household, leave just one, and close all other ones. Either pay them off as soon as possible, or transfer the amounts to the only credit card you’ll have from now on. No rewards and points are worth more than your financial Zen, trust me!

4. Combine all debts.

5. Decide together your savings goals. What do you want to save towards? What big purchases are on your horizon? Open savings accounts for all of them instead of piling money into a giant pile. Personally, I recommend Tangerine for all of your savings accounts because of their awesome service at the best price - absolute zero. With Tangerine you can have multiple savings accounts under one roof which will give you complete clarity of your saving progress.

Pingback: I Love You Like a Blogger Roundup - 8/22 | Enemy of Debt()

Pingback: Saving money by making eBay my friend |()