Resisting The Urge To Buy

Saying no to yourself can be hard. We’ve all been there - here’s this new thing we have in our mind. It’s shiny, new, and it’s absolutely awesome. It has all the latest bells and whistles. It’s high definition and it grills better burgers. It has better gas mileage and better upholstery. And it’s on sale! Whatever that is - I want it. Good god, I want it now, and I deserve it!

But I also know I can’t go around buying stuff. Between paying for everyday expenses such as mortgage, groceries, gas and bills, saving for larger purchases, and investing for the future, money tends to run out fairly quickly. If I acted on every single urge that comes in, I’d be out of money (unless I bought a money tree, but I haven’t seen one for sale).

Why is it so hard for me sometimes?

What makes things especially hard for me is that I get excited about new things very easily. My mind quickly jumps into rationalization mode and shows me 17 ways this new thing will make life awesome for me. If it’s a new barbecue, I can almost smell the freshly grilled meat and hear the noise of a party in the background. If it’s a car, the brain paints me the picture of long road trips in a shiny new car. If it’s a gadget - all the ways this new gadget will make me more productive.

People (and myself especially) are masters of rationalization. We can turn a “want” into “need” with a lightning speed. My mind almost whispers into my ear how I deserve this new thing - and why I should have it. ” - Come on, you’ve been working hard. It’s time to treat yourself a bit. You deserve it!”.

Grills quickly become investments into relaxation that we so badly need. New SUV - investment into safety (even though SUVs tend to be less safe to begin with). New iPhone - an investment into productivity (although the other iPhone was just as fine when it comes to Angry Birds).

My “magic” system to resisting the urge to buy!

Over the years, I’ve figured out the ways to drastically cut down on impulse buying - especially when it comes to larger purchases.

- Step 1: Think back to all the things I wanted to buy … and didn’t.

By now, I have a list of things I really wanted to buy but didn’t. Some of them look silly by now, some are quite reasonable but timing was wrong. Every time I get the urge to buy something, I look back to my experience, and think “Will it be like this time I wanted to buy … and didn’t? Will it look silly after a while as well?”

Chevrolet Camaro IROC-Z

For some reason, I really wanted to buy this car when I was much younger. I even looked at few for sale, but after a while my interest in it fizzled away. And thank goodness - the thing is butt ugly.

Honda Silverwing motorcycle

Just like anybody else, I went through “I want to ride a motorcycle” phase. I even saved up some money, and started looking around for used ones to buy. After a while, I found a decent Honda for sale, and met with the owner. The bike was in great shape, but I can’t say the same thing about the owner - he was using crutches. Apparently, he had a small accident on a motorcycle just few weeks ago that left him with broken legs, and that was the main reason for selling it. Let’s just say I lost interest in riding bikes on the spot.

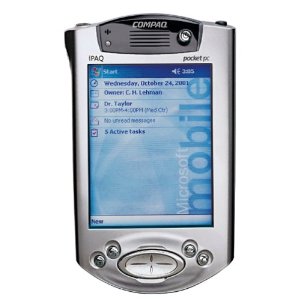

Compaq iPaq handheld computer

This was a hard one. The technology nerd in me was going overdrive screaming I really really need this. All the features appealed to me. I imagined myself being super productive with it, scheduling events, and sending emails. After waiting for few weeks, I’ve discovered the fact I can send emails just as easily from my computer, and scheduling works just as fine with a small notebook if needed. I wonder if these things are still around? Looks rather archaic by now.

- Step 2: Save money in cash

I made a promise to myself to never ever buy anything on credit. Every single purchase I make is only done with cash - and cash is saved up no matter how long it takes. Sometimes it’s just couple of months, sometimes it takes much longer - but I always save money in cash. Credit sure makes purchases easier - these days you can even buy pets on credit - but credit also makes it easier to follow through on foolish decisions.

- Step 3: Think how this purchase fits into my plan

Ultimately, you always want to be somewhat utilitarian. Ask yourself - what benefit will you get from this new purchase? How will it benefit your life as a whole? If you have goals you’re working on - how this new purchase helps you achieve them? Some purchases truly benefit you and your family - a second car will allow your partner to bring in a second income or make your life easier. A new flat screen TV (slightly bigger than your other flat screen TV) on the other hand doesn’t carry any benefits because the other TV is just as good - just smaller. Is high definition really worth the money?

- Step 4: Revisit the idea once money is saved up

Once I have the money in hand, and I’m staring at the item I want, I revisit the idea of buying it one more time. Do I still want it? Does it still appeal to me? I’ve worked really hard to save up the money and can almost see the sweat dripping from it - do I really want this new thing?

Countless times, I’ve walked away from the deal at this point of buying. For various reasons, I just didn’t want to go through the process after all the time and effort I put into saving the money.

Short version - just be patient.

Whatever your system to resisting the urge to buy, it all comes down to patience. Each of us has a couple personalities inside of us - rational frugal personality and “Oh good god, I want it now!” personality. One wants to follow the plan, stick to a budget, and save money. The other one is looking for party and good times. The party personality wants to buy the world, the frugal personality wants to save money and do boring things with them (such as investments, saving for the future, etc.). The best way to fight the urge to buy is to insert time between the urge and actual buying - chances are by that time my party personality moves on to wanting something else. Saving money in cash allows the time to pass and some common sense to kick in.

Hope this helps you with resisting the urge to buy!