Lottery is the only way to become a millionaire for an average person!

Become a Millionaire

This is the message being repeated over and over in today’s media - rich people are getting richer, and poor people are getting poorer. If you’re not born wearing a top hat and a monocle, your destiny in life is to be poor, and to work till you drop dead. Lottery and inheritance are the only legit ways for an average person to become wealthy and retire with dignity. The only way around is to get lucky and get yourself a union job with pension unless you can invent Google or Facebook. You won’t become a millionaire unless you start your own business.

Rubbish. Poppycock. Nonsense.

Your chances of winning a lottery are virtually non-existent. Inventing Facebook is kinda hard because it’s already up and running. Union jobs are scarce these days, and they are slowly going away, unfortunately. Inheriting money does happen - but do you really want to wait for it? Not to sound morbid, but do you really want to live your life waiting till your well-to-do uncle decides to expire? Besides, it still requires a well-to-do uncle with no kids - and he has to like you!

I must say, I’m amazed at the amount of this misinformation flying every which way in our society. We hear it from newspapers and magazines. In turn, we tell it to our kids and chat with neighbors about it. In our minds, there are two worlds - world of poverty and average everyday struggle, and a magical world of wealth. And nobody can cross the bridge unless they get “lucky”…

Let’s take an average Canadian

Here we have an average 20 year old young male, let’s call him Arthur. He may or may not have a degree. May be decided to take a couple of years off after high school to find himself - whatever that means. Arthur works at Starbucks serving your everyday morning fix - large caffee latte with a yummy blueberry muffin (can’t you tell I’m hungry?). Not exactly a high paying glamorous position, but Arthur is a down to Earth guy and isn’t high maintenance. No rich uncles, no union jobs for Arthur, and definitely no prospects of starting another Google. Can our average guy Arthur become a millionaire?

Let’s say Arthur decides to save $100 a month - nothing huge. What’s a hundred bucks to Arthur? Not a big amount of money, average young adult pays a little bit more in cell phone fees these days. Arthur takes $100 every month (or $50 every time he gets paid), and puts it into mutual funds. He’s not a financial nerd by any stretch of imagination, he simply buys them every month without changing his lifestyle or making big sacrifices. And he keeps doing it so for 45 years - through out his adult working life.

He loses his job at Starbucks for dropping muffins on the floor, and starts working at Home Depot - but every month he habitually puts $100 into mutual funds. Arthur goes back to school, picks up a trade and becomes a plumber - yet still every month puts away that hundred bucks into his investments. He even moves out, and meets a very special girl named Cindy and they settle down, have babies, move a few times, have a few fights but make up, go on vacations, fill up a few albums with photos, and finally turn 65.

How much money does Arthur have in his investment account?

By the end of his working life, Arthur is just a bit shy of being a millionaire - he has $996,202.87 sitting in his account to take care of his retirement expenses. Arthur, the average kid with no special skills and very questionable skills of handling muffins, no rich parents, no lottery winnings or Google fortunes, retires as a millionaire and lives happily ever after with Cindy occasionally visiting his kids. The only thing Arthur had going for him was time - and time turned his monthly $100 into a million bucks.

Become a Millionaire

What if Arthur did few things differently?

- If Arthur waited till he turns 30 to start saving money, he would only have $376,312.27. While it’s nothing to sneeze at, it certainly shows that time works to your advantage - and more time you have, the better results will be. Lesson here - start early. Preferably in your teen years.

- If instead of saving $100, Arthur decides to save $200 (or teams up with Cindy by contributing $100/month each for the future of their family), his investment account would hit cool $1,904,937.16.

- If Arthur decides to inflate his savings goal by 5% each year ($200/month first year, $210/month next year, $220.50/month year after that, etc.), Arthur and Cindy would retire as multi millionaires with $3,318,753.74 sitting in mutual funds. I think they’ll be just fine.

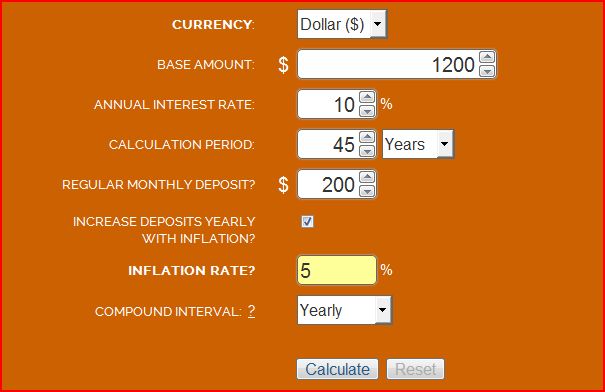

Play around with this calculator and plug few numbers for yourself. See what can be done over time with just small monthly contribution. For the sake of argument, I picked 10% as market return throughout - which is very realistic - and $1200 as starting capital.

Become a Millionaire

An average person can become a millionaire

In my mind, there’s just no excuse for anybody born in Canada NOT to retire as a millionaire. And I’m pretty sure everybody knows that saving over time can turn money into more money, but not everybody understands how drastically time can help you. You don’t have to be a financial nerd to become a millionaire - picking mutual funds is as easy as checking your engine oil. You don’t need to make huge sacrifices and eat cat food trying to save every penny - a hundred dollars every month will do. What’s $100/month to you?

The main point of my rant

Next time you hear somebody going off about how average people can’t get ahead, think of Arthur. How an average young adult with some determination can become a millionaire - just by sacrificing few dollars a day to save that $100 at the end of the month. If Arthur with just $100 can do it, so can anybody. No need for lotteries or rich uncles.