Overdraft fee on our account?

I am truly embarrassed. Just few weeks ago I rambled in lengths on how you should avoid getting overdraft fees by knowing when payments are supposed to come out of your account, and always making sure you have enough money in it. “Oh, only extremely dense people would let their account get overdrawn! You’re better than this!”

Well, guess what. I log into Mint.com (which is the best money management website ever, just FYI) on Friday, and I see that we’ve been charged an NSF fee. What the hell?

Overdraft Fee

Why did this happen?

For ages, my paycheck came into our account on Thursday night. On Friday morning, our mortgage payment would leave our account. I specifically picked every other Friday for our mortgage payments just so it is the same day as payday and I knew we would have money in our account. It’s always been like this, and it never changed once.

In fact, I started counting on this lately. Because we have rather aggressive savings goals this year, last few weeks I’ve been living a bit on the edge. I would move money between our checking and saving accounts trying to hit our goals rather aggressively, to the point that sometimes I would leave almost nothing in our chequing account. Out of my determination to hit our goals which borders on stubbornness, I flew a bit close to the sun. Counting once again that my paycheck will appear first in our account followed by our mortgage payment, I left our account too skinny.

But this Friday Murphy’s Law prevailed, and our mortgage payment showed up before my paycheck. Boom!

It doesn’t matter that my paycheck arrived shortly after. We didn’t have enough money in the account to cover the mortgage payment. And as a result, our bank refused the payment, issued an overdraft fee, and when I saw this I almost spilled coffee on myself. After all the hard lessons that I’ve had in my life when it comes to finances and preaching on my part how you should always be aware of your cash-flow, did I just cause an overdraft fee on our account?

Whose fault was this?

I’m not going to make up excuses for myself. It was 100% my fault for letting my stubbornness get the best of me. Yes, it’s great to have goals for your finances, and work hard on hitting them. But you should never leave your net empty, when you send your best players across the field to score some goals (yes, this is a hockey reference). This can have very dire consequences.

To add insult to injury, just few weeks ago my wife checked our account and noticed we’re flying unusually low to the ground - meaning we have unusually low account balance. She expressed concern about it, but I brushed it off. “- Don’t worry, honey. Your man will never let anything bad happen, I’ve got this!”

Overdraft Fee

What a perfect I-Told-You-So moment. Kill me now.

First results:

- $45 overdraft fee courtesy of President Choice Financial (our checking account) already been charged.

- $75 NSF fee courtesy of Macquarie Financial (our mortgage holder) that will follow.

- A huge load of embarrassment for me. Is this what crow dinner tastes like? Yuck!

I jump into action!

Fueled by my own embarrassment, I jump on the phone. Obviously, I can’t just ignore this rather negative event, but I also know that if I’m pro-active, it’s possible to avoid paying some of the fees. My plan is to beg for forgiveness until they stop me!

First I call our mortgage company and explain the mix-up to the best of my abilities.

Me: - Hello! My deepest apologies, but it seems to me that we’ve bounced a payment this morning. I just wanted to let you know that I’m truly sorry about it, and you can already debit our account for the full amount.

Very nice CSR: - Oh, I see. Thank you for letting us know and saving us time. We’ll debit your account shortly, and since this is the very first time you’ve bounced a payment, we’ll waive the NSF fee.

Me: - OMG, thank you so much!

Next, I call our bank and talk to them:

Me: - Hello! I just wanted to apologize for overdrafting our account this morning.

Very tired and emotionally withdrawn CSR: - Uhmmmm…ok.

Me: - Any chance you can remove the overdraft fee? This is the first one on our account.

Very tired and emotionally withdrawn CSR: - Not really, no.

Me: - I’ve been a client of this bank for a very long time; we have a number of products in our name. What can you do for me?

Very tired and emotionally withdrawn CSR: - Well, let’s see. I can probably meet you half-way. How does $20 instead of $45 sound?

Me: - Not nearly as good as a zero charge. Give me a break, it never happened before.

Very tired and emotionally withdrawn CSR: - Oh, fine. But next time you overdraft your account, this trick won’t work.

Me: - You’re the best. Won’t happen again!

Final results:

- President Choice Financial reimburses the overdraft fee within days:

Overdraft Fee

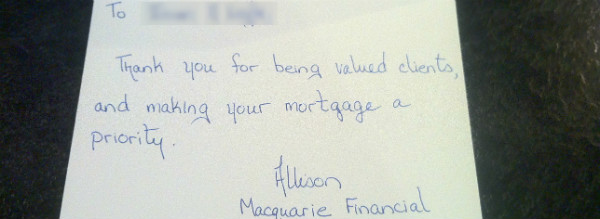

- Our mortgage company sends us a postcard. How nice:

Overdraft Fee

- We avoid paying $120 for my stupid mistake.

- Lesson #1: No matter how bad I want to hit our financial goals, I can’t live on the edge, and we should always have buffer in our daily account. Ideally, at the beginning of the month I’d like to have enough money in our account to cover all our expenses for the month. This way we never have to “time” our bills and paychecks.

- Lesson # 2: You can talk your way out of some overdraft fees. Of course, this won’t work if you constantly overdraft your account, but if you make a stupid mistake once in a while, banks can be surprisingly forgiving.

- Lesson # 3: My wife is one smart cookie 🙂

Overdraft fees by the numbers:

- Average overdraft fee charged by major banks is $34.

- Overdraft and non-sufficient funds fees accounted for 61 percent of total consumer deposit account service charges in 2011

- The amount in annual fees, on average, for accounts that had at least one overdraft or non- sufficient funds fee - $225