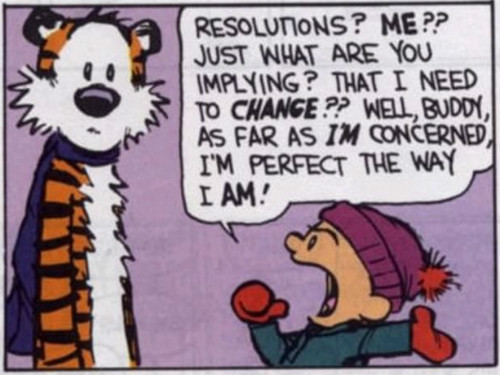

Excuse me for being stereotypical…

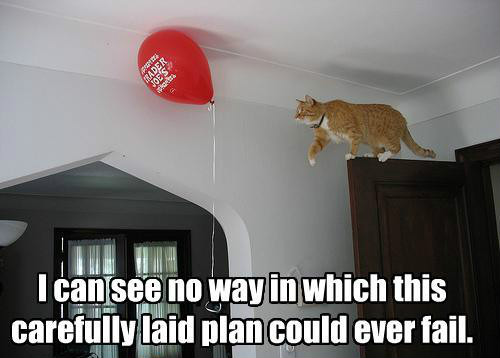

Now that the Christmas insanity is over and New Year’s partying ended, I’ve decided to sit down and come up with a few goals and resolutions of my own - seeing that so many financial bloggers are doing it. After all, if everybody else is jumping off the roof, then why shouldn’t … wait, bad example.

They say the difference between goals and wishful thinking is that goals have to measurable, exact, and have a time frame. Unfortunately, not all of my goals qualify fully. Also, far from all of my goals and resolutions are centered on personal finance. While I mostly ramble about money (hence “money ramblings”), I think of other things too, you know!

My plan is to revisit these goals and resolutions one year from now and see if I missed any of them - and how badly.

Goals and Resolutions

1: Invest 30% of our income

This isn’t exactly new to us - we’ve been diligently transferring a set percentage of our paychecks into a special account reserved for investments for few years by now. It used to be a much lower amount though - if I’m not mistaken we’ve started with 5% just to see how it feels. Once we’ve gotten used to losing 5% of our income, we’ve upped the bar to ten - and so on. We’ve reached thirty percent not too while ago and I don`t think it will change much from here - we’ve already cut our lifestyle quite a bit, and my wife might be right (I hope she doesn’t read me admitting it) in a sense that we shouldn’t be focused on just saving and investing money - we should enjoy it once in a while too. She is one smart cookie, eh?

Also, all of our investment income (dividends, distributions, and growth) gets re-invested - and we don’t spend it on our living expenses - not yet at least. This is simply because we want our assets (little pile of money/retirement account/freedom fund) to grow as fast as possible to the point when it starts growing by itself or even without our regular contributions. Wouldn’t be wonderful to have money working for us as opposed to us working for money?

Short and sweet: Invest 30% of our paychecks + 100% of all proceeds

2: Update my blog on a weekly basis

When I started this blog, I thought I’d update it every month or so. But for some reason I feel the urge to do it more and more often - every comment here or every new Twitter conversation get me fired up like I just made a new friend. I do appreciate people helping me and providing feedback - I just hope this blogging thing doesn’t become an obsession for me. After all, it’s just a place where I sort my thoughts out and voice some opinions (sometimes rather strong ones) without being called a numbers nerd by my friends.

Also, I think my little DIY blog needs a bit of a facelift. But I have no idea what a good looking blog should look like. I know mine isn’t exactly appealing and hard to read - so I think I’ll invest some time (or money if I have to) into redesigning it to bring readability up. If somebody can suggest changes or share some wisdom, I would be absolutely ecstatic.

Short and sweet: Update this blog every week and redesign it to make it user-friendly

3: Lose 50 lbs. of weight by budgeting

No, I’m not talking about cutting our grocery budget to $50/month and starving myself into thinness (because I tried it before and failed miserably). Recently, I had a bit of revelation. I’m not sure if you’ve noticed it, but I’m a bit of a geek when it comes to numbers - to me not a lot of things are equally satisfying as balancing our monthly budget or calculating rate of return on some investment (even if this investment is buying pickles in bulk). What if I could use my superpowers (if being a numbers nerd can be classified as a superpower) for good?

What is the key to losing weight? Most experts will say it’s balancing input (food consumed) with output (physical activity). What if I start tracking my consumption on everyday basis and balancing it against the energy I use - either by increasing my exercise or cutting down on consumption? They say just by tracking the numbers, people usually drastically improve their eating/exercise habits.

So, as one of my goals and resolutions, I am going to lose 50 lbs of my weight by the end of the year. Currently sitting at around 240 lbs., my weight can use a bit of an adjustment (to put it lightly), and an entire calendar year is a reasonable target. If you think about it, it’s only 4.16 lbs. /month - or just about a pound a week. I’m pretty sure I can do it!

Short and sweet: Lose 50 lbs. of weight by the end of 2014

Goals and Resolutions

4: Read a new book every two weeks

I used to read quite a lot. Unfortunately, lately I’ve noticed that slowly I switched to listening to podcasts and even comedy shows. While entertaining, they bring no new information for the most part.

So, as of one of my goals and resolutions for this year, I will pick a book every two weeks, read it from front to cover, and ponder over the material read. To make my life a bit easier, I will favor audio books as they’re easier to consume for me as I do chores around the house or commute to work - perhaps I’ll even invest some money into Audible membership. To keep myself a bit accountable, I will even post short book reviews if they happen to be on the subject of personal finance or just money in general. I even picked a new book already and started reading it!

Short and sweet: Read a new book every two weeks and post reviews if related to finance

5: Practice a bit of “selective ignorance”

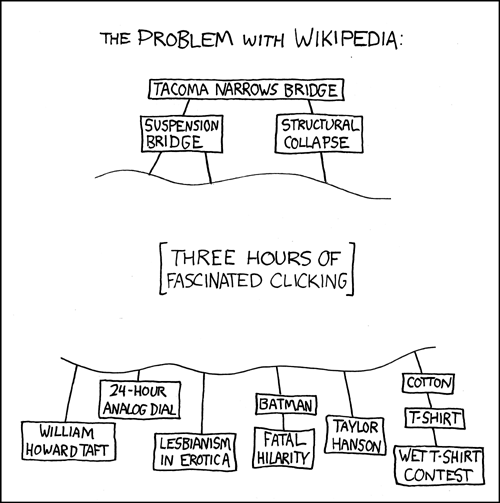

This is a bit of a wishy-washy goal. Another thing I’ve noticed about myself is that I spend too much time paying attention to things that don’t really matter to me. I’ll listen to a radio show about some phenomena in another country, start reading about it on Wikipedia, and pretty soon I will waste some good hours of my time over something I don’t really care about.

Goals and Resolutions

I’ve heard of low-information diet before, and I think it’s time to explore it. I should start asking myself “- How does this help me and my family reach our goals?” more often. Cause if it’s completely unrelated to me or my family, why do I even bother? And I’m not talking about going full-tilt and starting to live in a informational bubble without knowing what’s happening next door. But cutting down on informational noise can be quite beneficial to me, I think.

Short and sweet: Cut down on unnecessary and unrelated information intake.

Pingback: Why I don't want to buy a new car | Money RamblingsMoney Ramblings()

Pingback: How I’m tracking with my money goals | Let's make a million()