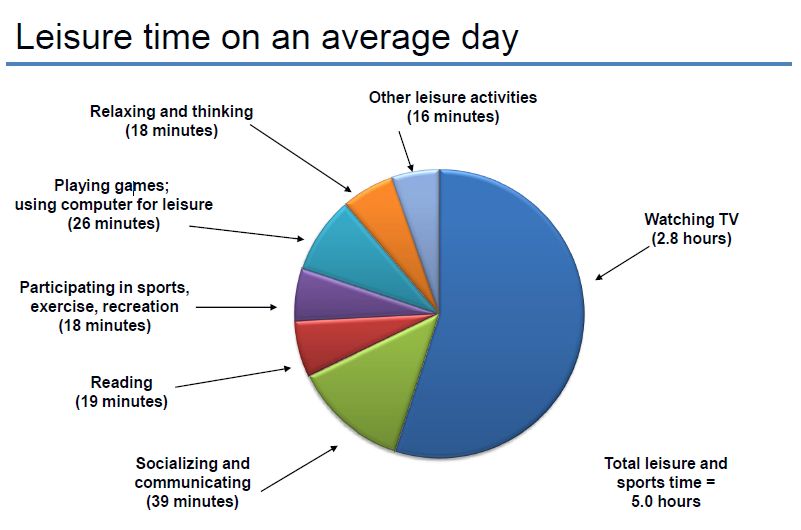

Here are some interesting stats for you:

- Average American spends 3 hours/day watching TV for a grand total of 90 hours/month

- Using your mobile device comes at 30 hours/month - talking, texting, playing games, etc.

- We spend 13 hours/month playing video games (obviously this number is much higher for younger people though some seniors might be addicted to Tetris, you never know).

- Exercising only takes around 9 hours/month for most people

- We socialize for almost 20 hours/month (including online and in person)

Rest of the time we spend working, sleeping, and eating. I could not find studies showing how much time we spend standing in front of the fridge pondering about food (at least 4 hours in my case) or arguing with your spouse whose turn it is to take the garbage out (none in our family - it’s ALWAYS me).

Managing money

What the study doesn’t show though is how much time an average person spends on managing money.

But let’s put these numbers into perspective. What is more likely to affect future for yourself and your family?

Is it the way you manage your money or how the latest season of Walking Dead ends? Is it the financial health of your family or yet another cat video on YouTube?

It only seems logical to me that we should be putting our efforts and attention towards something that will impact us the most. If you manage your finances properly, you will eliminate great chunk of stress in your life. You will avoid conflicts with your spouse. You’ll be able to afford to spend quality time with your kids. Heck, you might even retire decades ahead of schedule. Can cat videos on YouTube or latest Battlefield video game do the same for you? Probably not (unless you have the next Grumpy Cat and willing to pimp it out for some sweet moolah). So, what should come first then?

It doesn’t take THAT much time

So, I’ve decided to track the time I spend managing money. For the purpose of this “study”, I’ve kept track of everything I do that is in any way connected to managing finances for my family. I’ve tried to account for all activities and figure out how much time I spend on them on any given month:

- Checking account balances and categorizing transactions in Mint - 8 minutes/day or 3.3 hours/month.

- Budgeting for the month ahead - 30 minutes/month. This task is somewhat automatic by now as our budget doesn’t change much month-to-month.

- Paying bills and investing - 1 hour/month. Most of our bills are on autopilot, and require very little attention. Investing is also very simplified as it consists of buying a handful of ETF funds through online brokerage.

- Meeting with financial advisor - 30 minutes/month

- Education - 1 hour/day or 30 hours/month. This includes listening to personal finance podcasts, reading blogs, and an occasional book or two.

Grand total: 35.3 hours/month spent on money-related activities or only 5 hours on managing money.

Granted, we don’t make a lot of money. Our combined income hovers around average income for a Canadian household. I’d imagine higher income would require more time to manage your finances.

At the same time, our personal finances are simplified which makes it very easy to manage. If you have more than 2 bank accounts, consider closing extra ones and consolidating. I’ve done it for our family, and not only it saves serious money on bank account fees, but it requires less time to manage and makes everything more efficient.

How much time do you spend on managing money?