What if I said there is a risk-free investment with 13,940% profit over time?

Now, at this point you would probably laugh at my face. First of all, the return figure is way too high and comes close to that of Apple. Second, there is no such thing as risk-free investment besides GIC’s and money market accounts (and they return around 2% these days - barely keeping up with inflation).

But my investment does exist. And the returns are real. And they are indeed risk-free! And I’m not even Steve Jobs.

My 13,940% investment

Risk-free Investment

Now, before you close this page and/or start writing me an angry email about being misled, hear me out:

- I’ve always had short hair, at least since high school. Longer hair doesn’t look good on me. So, at some point I just started getting my head shaved. Every two weeks, I’d stop by a barber to make sure it doesn’t get out of hand - but then an idea of doing it myself and getting an electric razor popped into my mind.

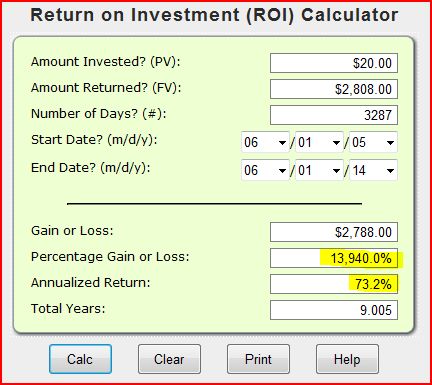

- My initial investment on it was $20. You can get it cheaper, but I went with quality in mind. And the quality paid off - the thing never let me down.

- I used to visit a barber to get my hair trimmed every two weeks, or 26 times a year. Each barber visit costs roughly $12.

- For the last 9 nine years, I’ve been trimming my own hair thus saving me $2808 in total (26 times * 9 years * $12)

Let’s plug these numbers into investment calculator to find out the return on my initial $20 investment:

Risk-free Investment

Total investment return: 13,940% (just below Apple’s stock returns of 15,000%)

Annualized return: 73.2% (average stock market return - 11%)

Risk factor: NONE (but the risk of being mistaken for Bruce Willis still exists!)

On a more serious note

Of course, I’m not trying to say that buying an electric hair trimmer is a real risk-free investment. The whole thing is meant as a joke, relax. It’s not really an investment, it’s just a razor that happens to save me money because I’m not very touchy about my looks and it makes my life easier. And I’m not trying to say that everybody should start shaving their heads to save money! I sure would not like if my wife started shaving her head - even if it made her look like Sinéad O’Connor (not that she would ever willingly do that no matter how much money it saves).

I think my main point is that if you are struggling with money or have goals of reaching financial freedom one day, you have to start thinking with long term in mind. I didn’t have a good start when it comes to finances, but I’m still trying to reach my goals by changing my financial habits.

Every single transaction/event in your life is either a benefit or a detractor to your financial well-being. You have to pay attention to them and know their long term effects when it comes to your financial picture. For example, ask yourself how these events affect you in the long run:

- Does getting your daily morning coffee on the way to work benefit you financially?

- What would going back to school and getting an advanced degree mean to your income and how it would stack up against the short term expense of school fees?

- Is getting a brand new car a sound financial decision and can you truly afford it along with higher expenses it brings?

- What makes more sense - paying off your mortgage earlier by throwing more money into it monthly or investing extra money and getting a higher return on it?

- Is commuting 50 kilometers every day to a higher paying job worth it despite higher transportation costs?

Biggest mistake people make

Just from talking to people and observing their decisions, I’ve noticed that most people don’t think their financial decisions through, no matter how big or small they are. Most people act on impulse, follow the herd, and don’t really pay attention to their financial picture. And this is the biggest mistake people make - not paying attention.

Maybe all of us should become a bit financially nerdy - start paying attention to our expenses, weigh options against each other, and think of long-term repercussions of our actions. You might not want to calculate the return on investment of a simple hair trimmer like I did today or calculating amount of money lost on smoking, but just paying a bit more attention to your financial health will be beneficial to you and your family in the long run.

Do you calculate returns of your everyday “investments”?