When I was much younger …

… I used to go camping almost every week with my friends. Growing up in Soviet Union (and later Russia) our camping trips were quite different from what kids these days do - we had no luxury of driving to a camping spot and bringing every item imaginable to use while we were there. Instead we were limited to what we could fit into our backpacks, and camped like little Spartans - no electricity, no running water, and total reliance on yourself.

We would cook our food from scratch with fish we caught, collect firewood and build our own fire, and sometimes even make our own shelter. So, you might say we were used to getting by with what we had instead of bringing everything and anything from home.

Naturally, just like every camper I’ve always packed my Swiss army knife when packing the day before. Swiss army knifes are ingenious because you’re basically carrying a dozen of tools with you that come in handy when the situation calls for it. Big blade is great for cutting down small branches. Small sharp blade is great for gutting fish. Little saw might not see action every day, but it can really help you out on occasion. Scissors are great when patching your tent. Can opener is quite awesome for opening cans, naturally. Some of these tools you’d use several times a day, and some hardly ever. But boy, that Swiss army knife helped on so many occasions.

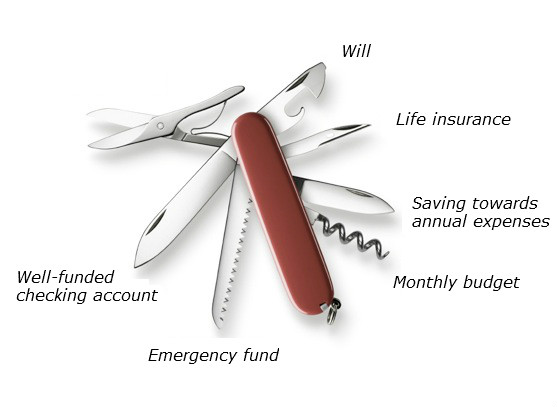

Swiss army knife of personal finance

Why would I start off by talking about my swiss army knife and what does it have to do with main topic of this blog - personal finance? Everything.

You can’t predict what will happen with you tomorrow. Life can go seventeen different ways from Sunday, and you have to be prepared for it. Being prepared financially for life’s turns takes a number of steps which over the years I’ve identified and implemented in my life. Hopefully, by sharing them with you, I can help somebody to be prepared financially for tomorrow.

Here’s our Swiss army knife of personal finance:

Tool #1: Well-funded checking account

Frequency of use: Every day

Why we need it: Our well-funded checking account is the first line of defense against financial disaster. It takes hits every day from all sides whether it is a utility bill or grocery shopping. While we usually spend every dollar we make either through consumption or saving it, our goal is to never run out of funds in our checking account. Instead of using overdraft protection to save our asses, we’ve decided on a minimum amount of money we need to have in our account. To grow this cushion, we’ve avoided spending money on some of the frivolities. Little by little, our checking account has risen to the point where it never dips below $1,000 although it always fluctuates up and down depending on bills and our income.

BONUS: Well-funded checking account can also save you monthly banking fees as many banking institutions waive their fees in exchange for min. balances.

Tool #2: Emergency fund

Frequency of use: Two or three times a year

Why we need it: Emergency fund is a small pile of money that sits in a separate savings account away from our main checking account. Emergency fund is the second line of defense. It’s meant to catch heavier blows to our finances that our checking account would not be able to sustain.

Traditional financial wisdom calls for a minimum of 3 months worth of expenses saved up separately for this purpose. Everybody is different though, and some people choose to have 6 months or even more than a year worth of expenses saved up.

We already had to dip into our emergency fund several times since we’ve started it. Once our car broke down on our trip to Vancouver and had to be towed almost 100 kms back home followed by a nasty repair bill from our mechanic. On a different occasion, our dryer decided to call it quits which required a visit from a repairman.

As far as financial disaster, emergency fund is a much better option than using credit as it is always available and doesn’t cost you anything. If you don’t have it, I would start one yesterday.

Tool #3: Monthly budget

Frequency of use: Every month (duh)

Why we need it: Monthly budgeting became an essential tool in our household few years ago. Before that we’d spend the money in accordance with our checking account level - if we had money, we’d spend it. If we didn’t, we’d tighten our belt.

Nowadays, we complete a monthly budget together as a family. We plan our expenses in accordance of our income and needs. While a budget won’t save your ass from a financial disaster, completing one will only benefit you in the long run.

BONUS: We use Mint.com to plan our monthly budgets and expenses. It’s completely free!

Tool #4: Saving towards annual expenses

Frequency of use: Every year

Why we need it: Annual expenses such as Christmas shopping and property tax bill used to deliver a heavy punch to our finances on a regular basis. Everything would be going smoothly for few months but suddenly out of nowhere (and I’m speaking sarcastically), a property tax bill would show up in the mail. All of sudden, we’d have to find almost $1,000 in our budget or take it out of our emergency fund. Same story would happen with annual car insurance or Christmas shopping season.

There had to be a better way! And we found it.

Step one: Identify annual expenses and their amounts

Step two: For every annual expense, figure out the amount of money you’d have to save on a monthly basis towards it to be ready for it when the time comes

Step three: Set up a separate savings account for this specific expense and transfer the amount you’ve determined monthly into it.

Step four: When the time comes, cash out this account and pay the expense in question with ease.

Currently we have 3 saving accounts set up for annual expenses:

- Property tax bill ($100/month)

- Car insurance ($85/month)

- Christmas gifts and charity ($150/month)

The small monthly transfer can be easily managed when we create our monthly budget. Most banks also offer automatic monthly transfers to make sure you never forget to save.

BONUS: We use Tangerine bank for all our savings accounts. Tangerine lets you open savings accounts connected to your checking account on the fly and provides all necessary tools to make saving money towards your annual expenses as automatic as possible. Overall, it’s a great bank, and I’ve raved about them on numerous occasions!

Tool #5: Life insurance

Frequency of use: Never

Why we need it: Neither me nor my wife make a lot of money. With both of us working we live a fairly comfortable life, but if one of us passed away it would make life very difficult for the other person. For example, if tomorrow I got hit by a bus on the way to work, my wife would have to carry all the expenses herself including the mortgage on our house. This would be fairly hard on sole income, at least at this moment while our incomes are relatively low.

Solution to this problem? A life insurance policy that would provide a comfortable living to the surviving party by paying out a large sum of money to be invested to create monthly cash flow thus replacing the income stream lost. Say, I get hit by a bus and my income goes away forever. But my wife is left with $750,000 that the life insurance policy will pay out. She then proceeds to pay off the mortgage on our house completely and invests the remaining balance. This creates a monthly income stream to her. Overall, she should be just fine financially although emotionally this would be devastating.

While some people view this as a morbid topic, I think everybody should plan for it or at least to have a conversation with their spouse about it. What would be the financial consequences of one of you passing away? Is life insurance something you need to have in your financial Swiss army knife? We certainly do, and this is why we have it.

Tool #6: Will

Frequency of use: Never

Why we need it: At the moment, we actually don’t have one. But it’s definitely on our radar ever since we took out a life insurance policy and started to think about the ultimate financial disaster such as this. We can’t predict life, but at least we can prepare for it.

We’re planning to put one in place this winter as soon as things slow down at work, and we can find a local professional that will guide us through the process.

Be prepared for a financial disaster!

Think about what would happen if a financial disaster struck today. How would you be able to respond? Would you be OK or would it devastate your financial life? Start planning for it and think of the ways you can prepare yourself and your family for it.

Pingback: To Borrow or Not to Borrow: When Does Applying for a Loan Makes Sense? | MORE than Finances()