Save Invest your money!

I’m a big proponent of investing money. While a lot of personal finance books and blogs usually focus mainly on cutting down your expenses and living within your means, I don’t think anybody ever got to financial independence solely by clipping coupons.

No, I’m not saying you should not save money. Saving money is great, but I think it’s just a part of the puzzle. If we ever want to reach financial independence, we need to wisely invest our money so it multiplies many times over. This is why I’ve always thought that part of our income should go towards investing.

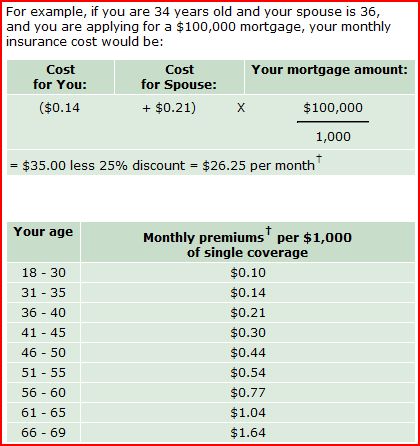

This is way we’re putting down $10,000 (holy crap, that’s a lot of money!) as an investment. The documents have been signed and mailed, cheque cleared, and soon we’ll receive share certificates along with our first monthly distribution.

Investing in solar energy?

My investment of choice is Solar Income Fund.

Solar Income Fund (or SIF) plans on acquiring/developing and operating a number of solar energy farms, mostly in Ontario. Some solar farms will be brand new, some will be existing operations. Just like income-producing rental homes, once built solar farms can be bought and sold by companies involved in investing in solar energy.

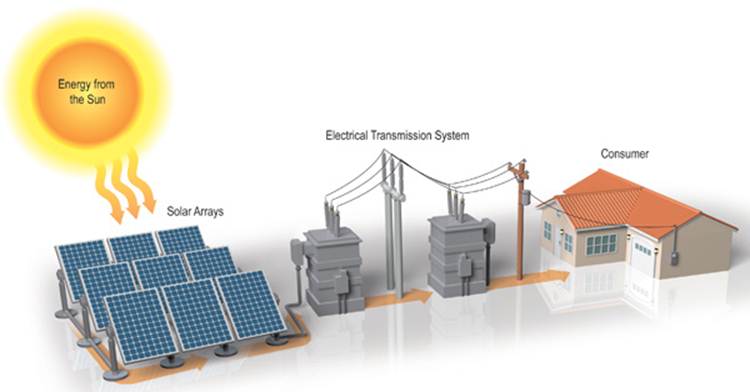

In case you’ve been living under a rock, solar farms are awesome and environmentally friendly way of producing electricity. An array of solar panels is installed on rooftops, farmland, or just open space to convert solar energy into electricity. Electricity then gets transferred into provincial electricity network and the owner of the farm gets paid for the amount of electricity produced. Solar panels don’t need to be maintained and are very self sufficient. They’re even insured against catastrophic events which would stop them from producing electricity and thus income.

The Solar Income Fund management team will select solar farms based on their viability, location, power-purchase agreements in place, and long term sustainability.

What makes investing in solar energy in Ontario appealing is the fact that Ontario government guarantees their feed-in rates for 20 years. This means once the purchase rate for a solar farm has been established and the system has been hooked into the system, the price Ontario government will pay for the electricity produced is guaranteed for two decades. Power purchase agreements (PPAs) remove a lot of risk associated with investing in solar energy simply because it makes the investment very predictable.

Why would Ontario government do this? This was part of Green Energy Act that was passed in 2009. Basically, Ontario plans to get away from energy produced by coal to solar energy because solar energy is much cleaner and efficient. They already shut down 19 coal units and remaining coal plants will be shut down by the end of 2014. The energy they have been producing will have to be replaced by solar energy farms. This is where third-party investors such as Solar Income Fund come in and invest their money into solar energy installations and start producing electricity.

Returns and exit strategy

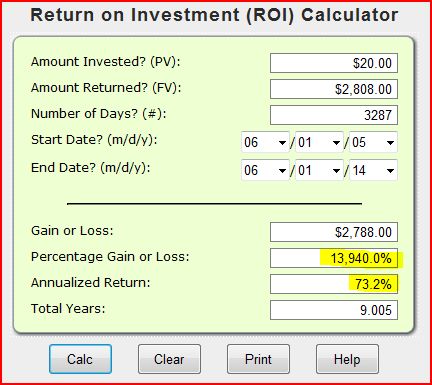

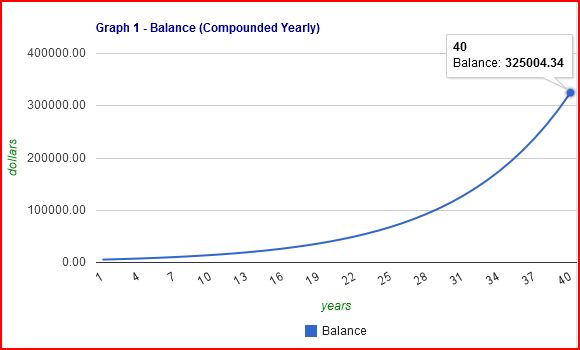

- The investment pays 9% annual return on investment paid out monthly via cheque or direct deposit. This is what’s called “hurdle rate” - until the company pays this out, the management of the company doesn’t get to enjoy the profits. In other words, it is in management team best interests to exceed the 9% rate of return on investment.

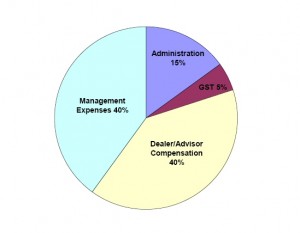

- Any income in excess of 9% is split between the investors and the management team with investors getting 60% of the extra income (while management gets 40%). The excess income is distributed annually to investors.

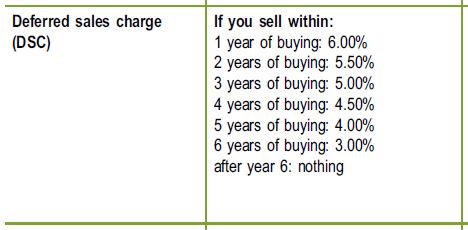

- This is not a liquid investment that you can buy and sell any time you want. Unlike public company stock that can be bought and sold on the open market, this is a locked investment. Once the capital is raised, the fund is closed for further investments and money is put towards purchasing of solar farms. The management plans to sell the fund to an institutional investor (bank, investment company, pension fund, or anyone else looking for a stable income producing investment), and return the capital to investors with an upside profit.

- Income produced with this investment is very tax-efficient. Capital gains are another story though.

Risks and concerns

Just like any investment, Solar Income Fund comes with risks and concerns. After mulling them over, I still went ahead with the investment since I think risks are well managed and thus minimized. But here are a few things that crossed my mind:

- Ability to produce consistent income.

This was my first concern about this investment. Nine percent return seemed high comparing to other dividend paying companies, right? But after looking at some numbers, nine percent looked very attainable. Solar power installations are money making machines! Once they’re built, they don’t require any expensive maintenance. Solar panel manufacturers guarantee their performance. The amount of money solar farm can produce can be predicted in advance given location and technical data.

Once the solar farm has been purchased or built, the money just keeps flowing in. Imagine being an apartment building landlord with extremely predictable tenants. Also, imagine that the government of Ontario guarantees that rent checks will keep getting mailed to you. All of a sudden, the risky business of being a landlord becomes very predictable and profitable.

- Flavor of the month investment?

As soon as I heard “solar energy”, I thought I’m about to hear a lecture on how green this investment is and how awesome it is for the environment. Solar energy has been around for ages by now, and always been a bit of hype. But solar energy in Ontario is there to stay. Ontario government guarantees their solar energy rates for 20 years, so the income that can be produced with solar energy isn’t going anywhere any time soon. Yes, it is a green investment, and will make a huge difference on Ontario’s environmental footprint. I’m super excited to be investing in solar energy because it’s green and pollution-free. But it will also produce income and hefty return for investors in the mean time.

Since 2003, Ontario reduced their coal-fired power use by 90%. By the end of this year, they plan to shut down remaining power plants, and make up for the loss in their energy output with solar farms. Almost 90% of solar farms installed in Canada are located in Ontario. Given all of this, investing in solar energy doesn’t sound like flavor of the month, more like a fundamental change in energy business in Ontario (with rest of Canada to follow, I hope).

By the way, the biggest players in solar energy market in Ontario are TransCanada and Enbridge. I don’t think they’d invest over one billion dollars combined in solar energy if it was just a flavor of the month investment 🙂

Heck, even Dragons Den moguls agree that they missed out on a great opportunity when it comes to investing in solar energy (scroll to 10 minutes 30 seconds mark):

- Experienced management team?

You can have a great business model and awesome prospects for profit, but an inexperienced team can ruin any business and you’ll kiss your money goodbye. After watching enough Dragons’ Den episodes, the role of the management team seems like a paramount factor in business success. This is why you should only invest in companies that have excellent management teams with lots of experience.

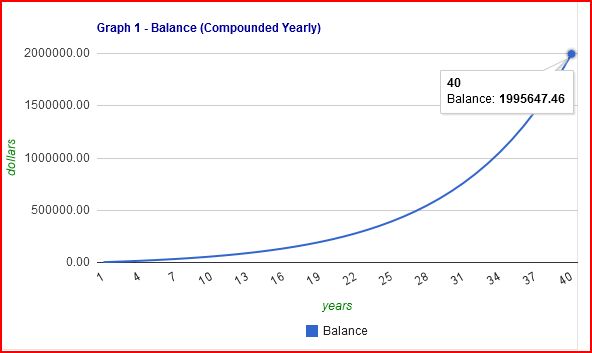

It just so happens that these cats have plenty of it. This is not the first solar energy fund they’re starting in Ontario. Including this one, they’ve started five solar energy funds; some of them already exited (have been purchased by an outside investor) with hefty returns touching on 18-19% (not too shabby!). While past performance doesn’t guarantee future results, this still instills confidence in their management team for me. I think my money is in good hands!

What’s next?

Now we’re just looking forward to receiving monthly checks in the mail that will put to use by investing it further into something else. When the fund exits and gets sold to an institutional investor, there should also be an upside return, which will come back to investors along with principal. It might take a while, but it sounds like the money will be hard at work all this time.

Also, next time I’m in Ontario, I really want to visit some of these solar power farms in person just to see my money at work! If this ever happens, I promise to post a picture of me right next to a solar panel! 🙂